How Prop Firms Are Changing the Trading Game for Individuals?

With proprietary trading businesses becoming major participants, the trading scene has changed dramatically recently. For independent traders, these companies provide special chances to acquire funds, resources, and assistance previously hard to get. This piece investigates eight ways prop companies are altering the trading environment for individuals.

Networking Prospectus

Many companies create a cooperative atmosphere wherein traders may exchange ideas, techniques, and knowledge. Also offering great networking chances is joining a prop company. Interacting with other traders could provide insightful analysis and fresh market viewpoints. This feeling of camaraderie could improve the whole trading process and help traders develop personally. In the trading environment, the contacts developed within a prop company may help one succeed over the long run.

See also: The Benefits of Deep Cleaning Services for Commercial Spaces

Complete Training Courses

Prop businesses may give their traders’ training and development top priority, which greatly influences individual trading performance. Many companies provide access to instructional tools, mentoring, and organized training courses. Novate traders who may not know the markets can especially benefit from this help. Investing in trader education enables prop businesses to assist people in honing their abilities and enhancing their trading plans. Constant help from seasoned traders may provide insightful analysis and direction, hence promoting an always-learning culture. This focus on training and development improves personal performance and helps the company to be generally successful.

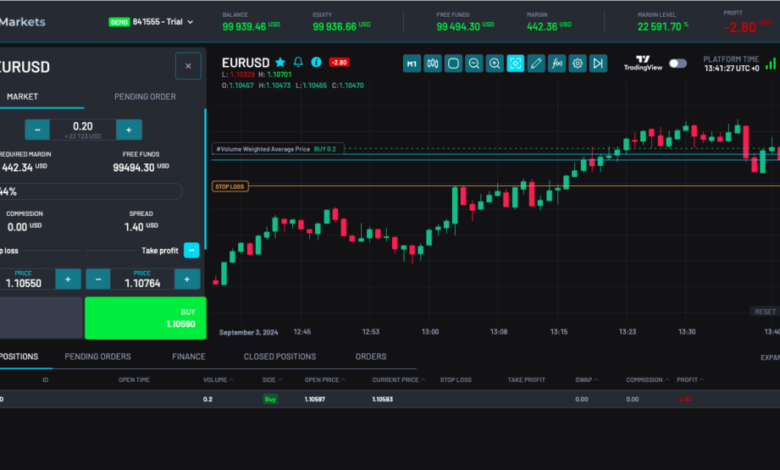

Modern tools and technologies

Another way prop companies are altering the trading scene for people is by combining cutting-edge technologies with trading instruments. Many companies fund innovative trading systems, analytics tools, and algorithmic trading platforms. These tools let traders precisely execute deals and more successfully examine market data. Having access to advanced tools can help a trader greatly improve their capacity for wise judgments and rapid reaction to changes in the market. The need for technology to reach success cannot be emphasized as the trade environment becomes more competitive. Prop trading firms that give technology developments priority provide individual traders the tools they need to shine.

Adaptable trading environments

Many times, proprietary trading companies provide adaptable trading environments that fit different trading methods and approaches. Unlike conventional financial organizations, which could have rigorous policies, prop companies usually let traders run with more freedom. This adaptability helps traders to create and use their methods free from needless limitations. Many prop companies also provide remote trading choices, thus enabling traders to operate from wherever in the globe. In the fast-paced trading climate of today, when rapid response to market circumstances is absolutely vital, this versatility is very attractive. Prop companies’ flexibility draws a wide spectrum of traders, which helps to explain their increasing appeal.

Compensation Based on Performance

Prop companies are renowned for their performance-based pay systems, which balance trader interests with company ones. Usually getting a share of the profits they create, traders are motivated to perform as effectively as possible. This approach creates a competitive environment where traders are driven to improve their competency and get consistent outcomes.

Unlike conventional employment structures, where pay may not match individual accomplishment, prop companies actively reward success. This strategy promotes a culture of excellence within the company in addition to attracting gifted traders. Prop businesses are positioned to satisfy the need as more traders look for performance-oriented prospects.

Efficient Risk Management

Prop companies usually provide strong help in this regard. Many companies have set risk control systems to let traders reduce possible losses. Guidelines on position size, maximum drawdown restrictions, and trade execution techniques might all fall under these systems. Following these risk-reducing strategies helps traders guard their cash and make better judgments. Particularly for less experienced traders who may not yet have a strong understanding of risk management techniques, the help given by prop businesses in this respect might be very helpful.

Strengthened Emphasize trading

Working with a prop company finally lets traders concentrate only on trading, free from the distractions of other obligations. Many traders balance many employment or obligations, which might affect their performance. Traders who work for a prop company may commit their time and effort to improve their trade execution and skill set. Improved performance and more market success might follow from this concentrated atmosphere. One major benefit that prop companies provide to their traders is their capacity to focus on trading free from other demands.

Conclusion

Through access to cash, thorough training, innovative technology, flexible workplaces, and performance-based rewards, proprietary trading companies are drastically altering the trading scene for people. These benefits provide traders seeking to improve their abilities and succeed in the markets with a beautiful scene. Prop companies are probably going to become more and more important as the trading sector develops as they draw a wide spectrum of expertise and encourage creativity. Working with a respectable prop company may provide prospective traders with the tools and help needed to succeed in the cutthroat trading environment.